What is Confirmation of Payee (CoP)?

Confirmation of Payee provides a layer of protection for payments you make to someone else's account. The CoP service checks the account details you enter for the payee with the account details held by the receiving bank, and tells you if the account details match or not.

How does Confirmation of Payee work?

When confirming a domestic payee's details before you proceed with a payment, the system will check the bank account details you enter against the account details held by the recipient’s bank.

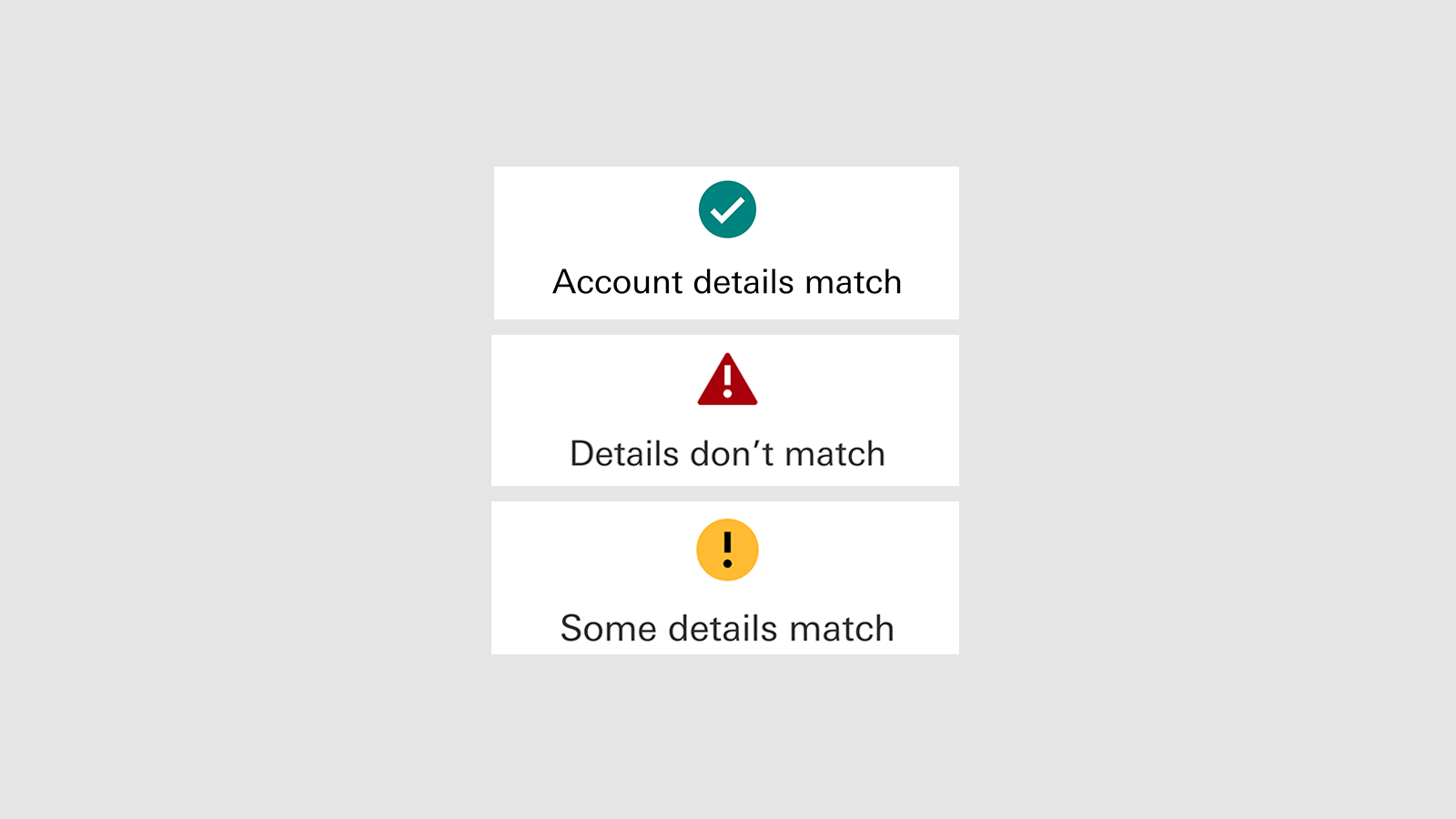

The CoP service checks the account name, BSB (a 6-digit code that identifies the bank and branch where the account is held) and account number you’ve entered against the details held by the recipient’s bank. It then determines whether there’s a match or a close match, or the details don’t match at all.

You will be shown a prompt on screen, which will tell you whether the two sets of account details match or not.

You can then make an informed decision about what to do next: pay, check the details again or choose not to proceed with the payment at all.

All CoP information is passed securely between financial institutions to ensure your data remains safe.

How Confirmation of Payee helps you

- Check account details before you make a paymentBy checking the accuracy of account details before you make a payment, you can decide if you want to proceed or not.

- Don't pay the wrong personCoP helps you avoid mistaken payments by making you aware when you make a typo or you're given incorrect details from a payee.

- Become more aware of scamsEspecially helpful with false billing scams, where scammers hack a business email account and redirect payments or request fake payment emails.